Even if you are a new investor in the crypto space, you have probably come across the term “fully diluted market cap.” But what does it mean?

What is fully diluted market cap?

Fully diluted market cap represents the maximum possible value of all tokens or coins, including those that have not yet been released, based on the total potential supply and the current price.

The formula for calculating fully diluted market cap is: Fully Diluted Market Cap = Maximum Potential Supply * Current Price.

Calculated by multiplying the maximum potential supply with the current price, this metric provides a comprehensive assessment of the cryptocurrency’s value. It allows stakeholders to consider both existing and future digital assets when making investment decisions, ensuring a well-informed allocation of their money.

Key takeaways

- Fully Diluted Market Cap (FDMC) takes into account a cryptocurrency’s maximum supply, including tokens or coins that are not yet outstanding, providing a comprehensive understanding of its potential monetary value.

- FDMC is a valuable metric for assessing scalability, future market demand, and the potential value of cryptocurrencies, assisting stakeholders in predicting their future trajectory.

- By staying updated on the latest developments and innovations in the cryptocurrency space and analyzing fully diluted market cap (FDMC), investors can remain informed and spot emerging opportunities that could enhance their investment potential.

Example: Calculating Fully Diluted Market Cap for Bitcoin

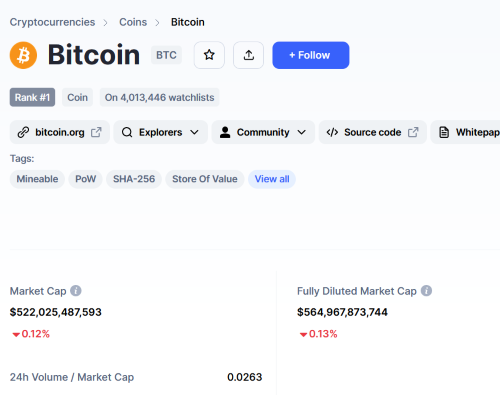

Let’s take Bitcoin as an example. As of writing this article, the currently available supply of Bitcoin is around 19.4 million digital units, and its price is hovering around $26,9. However, the total supply of Bitcoin is capped at 21 million coins. There are approximately 1.6 million coins still awaiting release.

The Fully Diluted Market Cap of Bitcoin can be calculated by multiplying the total supply of Bitcoin (21 million) by its current price ($26,900). So, the FDV of Bitcoin is $565 billion ($26,900 x 19,4 million). This metric estimates the future market capitalization of Bitcoin once all its tokens have been released.

It provides insights into Bitcoin’s potential for growth and future success. While fully diluted market cap (FDV) provides valuable insights, stakeholders should avoid relying solely on this metric. It is essential to consider other critical factors, such as project updates, adoption rates, and the overall market conditions, before making any financial decisions. A comprehensive evaluation will lead to more informed and prudent investment choices.

Key Terms: Market, Market Cap, and Diluted

Now, let’s break down some of the key terms used in this metric. The market refers to the environment in which the trading of assets takes place. The market cap, short for market capitalization, is a metric used to measure the size of a company or asset. It is calculated by multiplying the circulating quantity by the present price of the token or coin.

The term “diluted” refers to the fact that not all tokens or coins are currently available. A portion of the coins may still be held by the project team, locked in smart contracts, or in the possession of stakeholders. By including these tokens or coins in the calculation, we get a more accurate representation of the potential highest possible value of the asset.

Market Cap vs Fully Diluted market cap

Market Cap

The market cap represents the total value of a cryptocurrency in circulation. It is calculated by multiplying the present price of the cryptocurrency by its available quantity. The market cap provides a snapshot of the cryptocurrency’s overall value based on its present market price.

What is Fully Diluted market cap for investors?

By taking into account the maximum potential circulation of digital assets, a fully diluted market cap offers a more comprehensive perspective. It allows investors to understand the upper limit of the market’s valuation, considering all tokens that could potentially be in circulation.It includes not only the circulating supply but also those that are yet to be released. FDMC is calculated by multiplying the current price of the crypto by its highest available quantity.

This metric offers an estimation of the cryptocurrency’s value if all tokens or coins were in circulation.

Conclusion

The market cap of a cryptocurrency is the total value of the digital asset, which is calculated based on its current price and the number of coins or tokens in circulation. It offers a snapshot encompassing the comprehensive value of the cryptocurrency. On the other hand, a fully diluted market cap (FDMC) provides a more comprehensive view as it takes into account the maximum potential circulation of digital assets, encompassing tokens or coins that have not yet been released. This metric offers a broader understanding of the cryptocurrency’s overall valuation.

To calculate FDMC, you multiply the current price of the cryptocurrency by its highest potential supply. While the market cap reflects the current state, FDMC estimates the cryptocurrency’s value if all tokens were in circulation. Both metrics indicate the value and potential of a cryptocurrency, with FDMC offering a broader perspective by accounting for the highest possible supply.

Why are Market Cap and FDMC Important for Stakeholders?

1. Investment Assessment

The market cap enables stakeholders to assess the magnitude and popularity of a cryptocurrency within the market. A higher market cap often indicates a larger investor base and increased liquidity, making it potentially more attractive for investment.

On the other hand, FDMC takes into account the highest potential value of a cryptocurrency, offering valuable insights into its scalability and long-term growth prospects.

2. Evaluating Buy-in Opportunities

Market cap assists stakeholders in identifying cryptos with larger market presence and established track records. Conversely, FDMC helps stakeholders assess the potential growth of a cryptocurrency that may have a significant discrepancy between its current market cap and its fully diluted market cap. This knowledge aids investors in making informed decisions about buying opportunities.

3. Project Updates and Development

Market cap reflects the current market sentiment and valuation of a cryptocurrency, indicating its perceived value among investors and traders. It can be influenced by project updates, technological advancements, or regulatory developments. FDMC, while not impacted by immediate updates, helps stakeholders assess the cryptocurrency’s long-term growth potential by considering its highest possible supply.

4. Investing with Risk Awareness

Market cap and FDMC help stakeholders understand the risk profile associated with cryptocurrency investment. Comparing the market cap to the fully diluted market cap provides insights into the potential dilution of existing tokens, influencing price stability and future value considerations. It enables stakeholders to assess the risk-reward ratio more comprehensively.

In summary, the market cap provides a snapshot of a cryptocurrency’s value, while FDMC offers a broader perspective by considering its highest potential supply. Considering both metrics allows stakeholders to make well-informed financial decisions, assess scalability and growth prospects, and evaluate risk-reward profiles in the ever-changing landscape of cryptocurrencies.

Predicting the future with fully diluted market caps

Fully diluted market caps (FDMC) hold the potential to offer valuable insights into projecting the future of cryptocurrencies. By considering the highest potential amount of digital currencies, FDMC offers a comprehensive view of a cryptocurrency’s scalability, growth prospects, and the services it aims to provide.

Gaining a comprehensive understanding of FDMC and its implications empowers stakeholders to make informed predictions about the future trajectory of cryptocurrencies.

1. Assessing Potential

FDMC signifies the theoretical peak value a cryptocurrency could attain if all its assets were in circulation. By considering the services and solutions a cryptocurrency aims to provide, investors can assess its potential adoption and scalability in the future.

A higher FDMC indicates that the cryptocurrency has potential for expansion and growth, enhancing its likelihood of becoming a prominent player in the market.

2. Evaluating Market Demand

FDMC aids in evaluating the market demand for a cryptocurrency. If the FDMC is significantly higher than the present market cap, it indicates a strong potential for upcoming demand and adoption. This can serve as a positive indicator for investors seeking to anticipate the popularity and adoption of a cryptocurrency.

3. Potential Monetary Value

FDMC provides insights into the potential future monetary value of a cryptocurrency, aiding investors in their assessments and predictions. By considering the highest possible circulations, stakeholders can estimate the value of each token or coin if the cryptocurrency achieves widespread adoption. This information is crucial for predicting potential returns on investment and making informed decisions.

4. Latest Developments and Innovation

Analyzing FDMC in conjunction with the latest developments and innovations in the cryptocurrency space allows investors to anticipate future trends. Through monitoring a cryptocurrency project’s progress and its adherence to its roadmap, stakeholders can gain valuable insights into its potential value and long-term viability.

Staying informed about the latest advancements assists in predicting whether the cryptocurrency has the capability to disrupt existing industries or present innovative solutions.

Summary

Predicting the future of cryptocurrencies requires a holistic approach that goes beyond present market caps. FDMC offers a glimpse into a cryptocurrency’s scalability, market demand, potential monetary value, and developments driving its progress.

By analyzing these factors, stakeholders can make more accurate predictions about the future trajectory of cryptocurrencies and position themselves for potential growth and success.